USDT Demand Stalls as Tether Burns $3 Billion: Is the Stablecoin King Losing Its Crown?

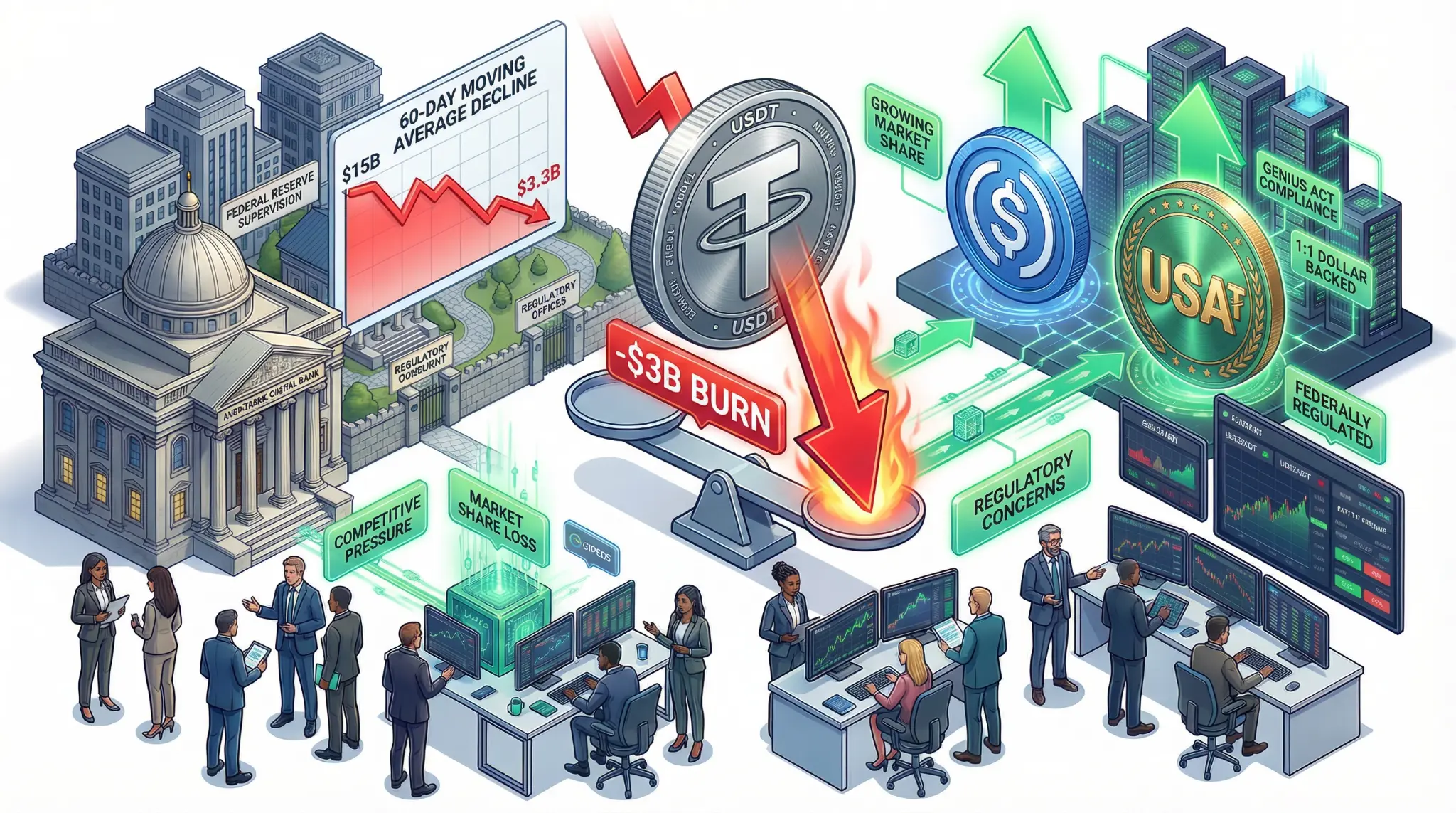

In a troubling development that has caught the attention of market analysts and investors, Tether's USDT stablecoin has experienced a significant slowdown in demand, with the 60-day moving average of market cap growth declining from $15 billion to approximately $3.3 billion [1]. More alarming, Tether has burned over $3 billion in USDT during January 2026, raising concerns about potential capital outflows and a shift in market preferences away from USDT toward competing stablecoins [1].

The stalling of USDT demand is particularly significant given that USDT has maintained its position as the largest stablecoin by market capitalization for years. USDT's market cap exceeds $100 billion, making it the de facto standard for stablecoin transactions across the crypto ecosystem. However, the recent slowdown in demand growth suggests that this dominance may be under threat [1].

"The stalling of USDT demand is a critical inflection point for the stablecoin market. For years, USDT has been the undisputed leader, but the emergence of competing stablecoins like USDC, and now USA₮, is creating a more competitive landscape. If Tether cannot stem the slowdown in demand growth, it could lose market share to competitors," analysts said [1].

Several factors are contributing to the slowdown in USDT demand. First, the emergence of federally regulated stablecoins like USA₮ is creating alternatives for institutional investors who have been hesitant to use USDT due to regulatory concerns. Second, Circle's USDC stablecoin has been gaining market share, particularly among institutional investors and DeFi protocols. Third, the overall growth rate of the stablecoin market has slowed as the market has matured [1].

| USDT Demand Metrics | Current Status | Significance |

|---|---|---|

| 60-Day Moving Average | $3.3 billion (down from $15B) | Significant slowdown. |

| January Burns | $3+ billion | Capital outflows. |

| Competitive Pressure | USDC, USA₮ | Market share threats. |

| Regulatory Status | Unregulated | Institutional hesitation. |

| Market Share | ~50% of stablecoin market | Under pressure. |

The burning of $3 billion in USDT during January is particularly concerning because it suggests that holders of USDT are actively converting their holdings into other stablecoins or fiat currency. This is a reversal of the trend that has characterized the stablecoin market for years, in which USDT has consistently grown as users have adopted stablecoins for trading, payments, and other use cases [1].

The slowdown in USDT demand also has implications for Tether's business model. Tether generates revenue primarily through the spread between the yield on its reserve assets (typically short-term US Treasury securities and other high-quality assets) and the interest it pays on USDT holdings. As USDT market cap growth slows, Tether's revenue growth will also slow, which could impact the company's profitability [1].

For traders, quants, and investors, the slowdown in USDT demand is significant for several reasons. First, it suggests that the stablecoin market is becoming more competitive, with institutional investors increasingly willing to use alternatives to USDT. Second, it indicates that regulatory concerns about USDT are driving some users toward federally regulated alternatives. Third, it could impact Tether's business model and profitability. Fourth, it suggests that the stablecoin market is maturing, with growth rates slowing as the market reaches saturation [1].

The slowdown also has implications for the broader crypto market. USDT is the most widely used stablecoin for trading on crypto exchanges, and a significant shift in demand away from USDT could disrupt trading patterns and liquidity on crypto exchanges. If traders shift to USDC or other stablecoins, it could reduce USDT's utility as a trading pair, which could further accelerate the shift away from USDT [1].

However, it is important to note that despite the slowdown in demand growth, USDT remains the dominant stablecoin by market capitalization. The $3 billion in burns during January represents only a 3% decline in USDT's market cap, which is relatively modest. For USDT to truly lose its market leadership position, there would need to be a much more significant shift in user preferences [1].

References

[1] USDT Demand Stalls, January Signaling Potential Shift in Stablecoin Preferences

Related Articles

US Banks' Stablecoin Scare: A Flawed Plea to Protect Trillions, or a Call for Fair Competition?

At the heart of the banks' apprehension is the potential for stablecoins, digital currencies pegged to the value of the U.S. dollar, to evolve beyond mere payment mechanisms into interest-bearing savings vehicles. Should this occur, they argue, consumers and corporations alike would be incentivized

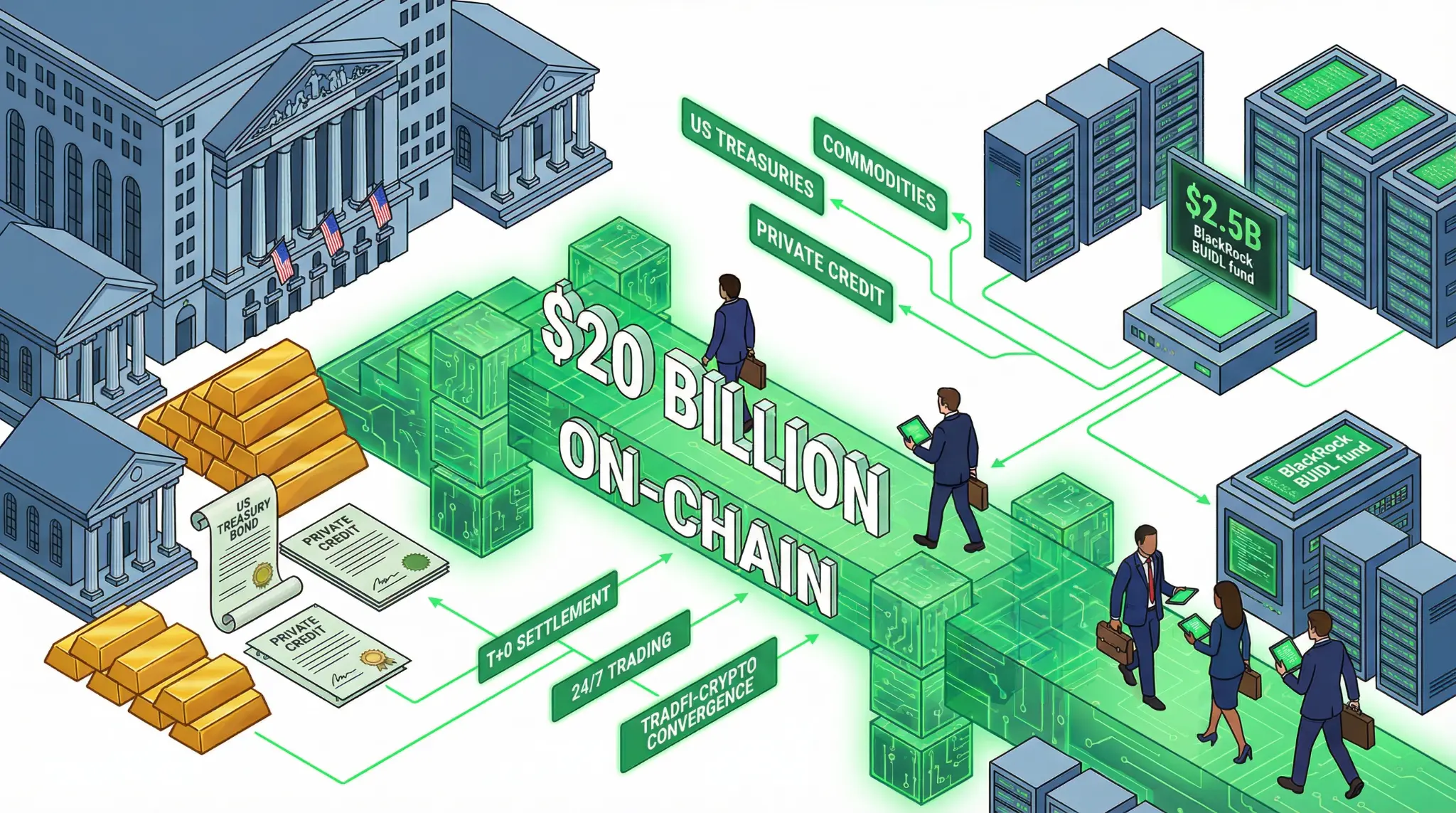

$20 Billion in Tokenized Securities Now On-Chain: The TradFi-Crypto Convergence Accelerates as Wall Street Embraces Blockchain

$20 billion in tokenized securities now on-chain, led by US Treasuries and BlackRock's $2.5B BUIDL fund, with Bernstein projecting 4x growth to $80B by year-end as TradFi-crypto convergence accelerates.

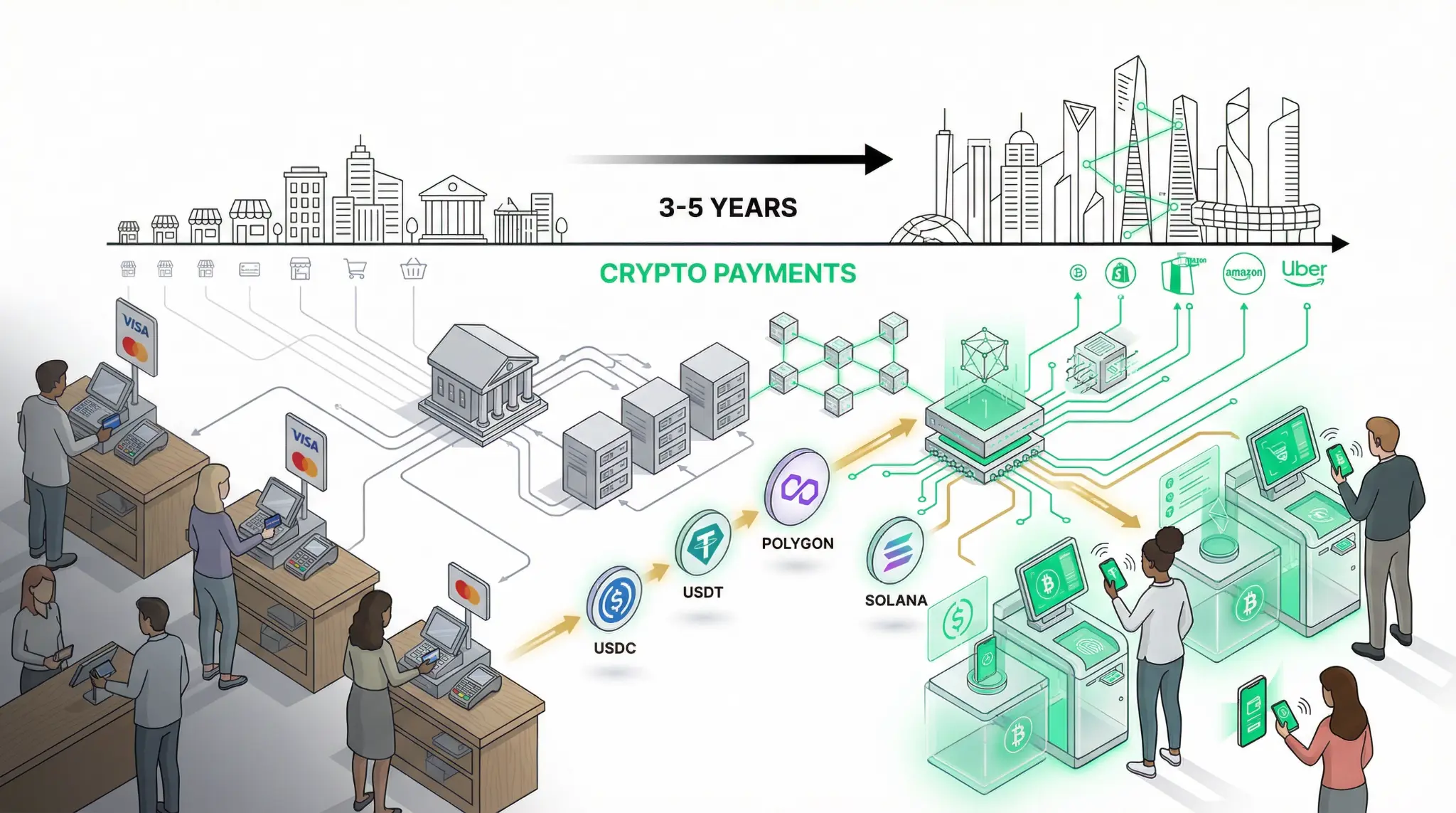

Crypto Adoption Reaches 39% in US Retail: Stablecoins and Fintech Drive Mainstream Payments Inflection Point

In a landmark report that demonstrates the accelerating mainstream adoption of cryptocurrency, AInvest has released analysis showing that cryptocurrency adoption in US retail payments has reached 39% in 2025, driven primarily by stablecoins and fintech platforms like PayPal. This represents a critical inflection point in the adoption curve, suggesting that cryptocurrency is transitioning from a niche asset to a mainstream payment method.