$20 Billion in Tokenized Securities Now On-Chain: The TradFi-Crypto Convergence Accelerates as Wall Street Embraces Blockchain

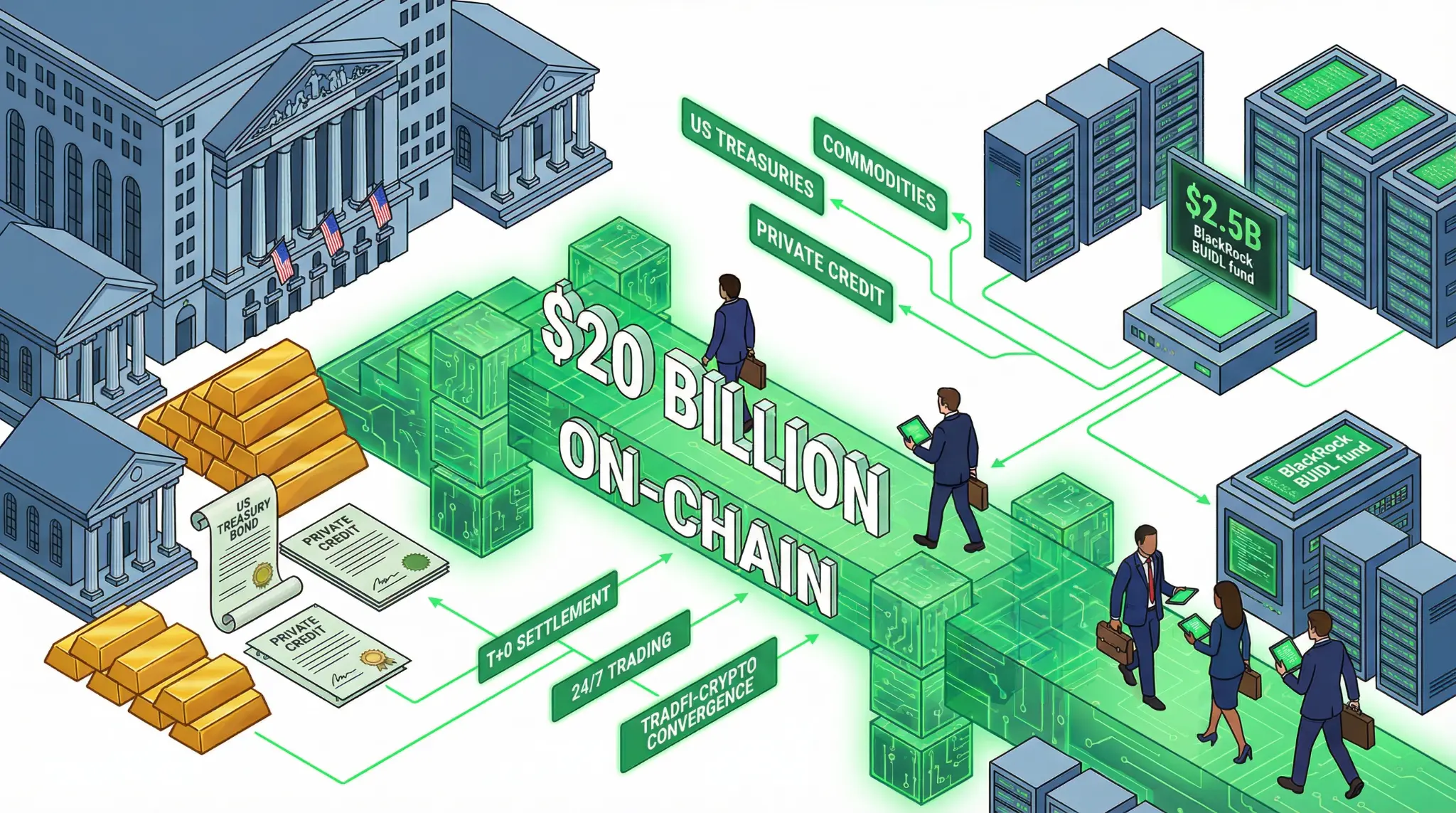

In a landmark development that signals the acceleration of real-world asset (RWA) tokenization, an estimated $20 billion in tokenized securities products now exist on-chain as of January 2026, predominantly consisting of US Treasuries, commodities, and private credit instruments [1]. This represents a critical inflection point in the convergence of traditional finance (TradFi) and cryptocurrency, as institutional investors and financial institutions increasingly recognize the efficiency and liquidity benefits of blockchain-based asset tokenization [1].

The $20 billion figure is particularly significant when considered in the context of the broader RWA market. Elliptic, a leading blockchain analytics firm, forecasts that meaningful convergence between cryptoassets and TradFi will accelerate in 2026, driven by RWA tokenization. This convergence is not merely a technical development; it represents a fundamental shift in how financial assets will be issued, traded, and settled in the future [1].

"We are witnessing the beginning of a fundamental restructuring of financial markets. RWA tokenization is not a niche use case; it is the future of how all financial assets will be managed. The question is not whether tokenization will happen, but how quickly and at what scale," Elliptic analysts said in a statement [1].

The composition of the $20 billion in tokenized securities is revealing. US Treasuries represent the largest component, reflecting institutional investors' appetite for blockchain-based versions of the world's most important safe-haven asset. Commodities like gold and oil represent the second-largest component, reflecting the efficiency benefits of 24/7 trading and settlement. Private credit instruments represent the third-largest component, reflecting the growing use of blockchain infrastructure for private market transactions [1].

| RWA Tokenization Metrics | Specification | Significance |

|---|---|---|

| Total On-Chain Securities | $20 billion | Significant scale. |

| Largest Component | US Treasuries | Institutional confidence. |

| BlackRock BUIDL Fund | $2.5 billion | Major institutional player. |

| Projected 2026 Market | $80 billion | 4x growth expected. |

| Primary Use Cases | Treasuries, commodities, private credit | Broad applicability. |

| Settlement Speed | Near-instant (vs. T+2 traditional) | Major efficiency gain. |

| Trading Hours | 24/7 (vs. 9:30-4:00 traditional) | Expanded market access. |

One of the most significant developments in RWA tokenization has been BlackRock's BUIDL fund, which holds $2.5 billion in tokenized US Treasuries. The fact that the world's largest asset manager has launched a product that holds tokenized securities is a powerful signal of institutional acceptance of blockchain-based financial infrastructure [1].

The convergence of TradFi and crypto is also being driven by the efficiency benefits of blockchain-based settlement. Traditional securities settlement operates on a T+2 basis (two business days after the trade), while blockchain-based settlement can occur near-instantaneously. This efficiency advantage is particularly valuable for institutional traders and market makers, who can significantly reduce their capital requirements and operational complexity by using blockchain-based settlement [1].

For traders, quants, and investors, the acceleration of RWA tokenization is significant for several reasons. First, it represents a fundamental shift in how financial assets will be managed in the future. Second, it suggests that institutional investors are increasingly comfortable with blockchain-based infrastructure for managing critical financial assets. Third, it indicates that the tokenization of all major asset classes is likely to accelerate significantly in 2026 and beyond. Fourth, it creates significant opportunities for developers and service providers building infrastructure for tokenized asset trading and settlement.

The convergence also has implications for the broader crypto market. As more traditional financial assets are tokenized and moved on-chain, the distinction between "crypto" and "traditional finance" will become increasingly blurred. This could drive significant growth in blockchain infrastructure companies and crypto-native financial service providers [1].

Bernstein has projected that the RWA market could reach $80 billion by 2026, representing a 4x increase from current levels. If this projection proves accurate, it would represent one of the most significant developments in financial markets in recent years [1].

References

[1] Cryptoasset and TradFi Convergence Set to Accelerate in 2026

Related Articles

US Banks' Stablecoin Scare: A Flawed Plea to Protect Trillions, or a Call for Fair Competition?

At the heart of the banks' apprehension is the potential for stablecoins, digital currencies pegged to the value of the U.S. dollar, to evolve beyond mere payment mechanisms into interest-bearing savings vehicles. Should this occur, they argue, consumers and corporations alike would be incentivized

USDT Demand Stalls as Tether Burns $3 Billion: Is the Stablecoin King Losing Its Crown?

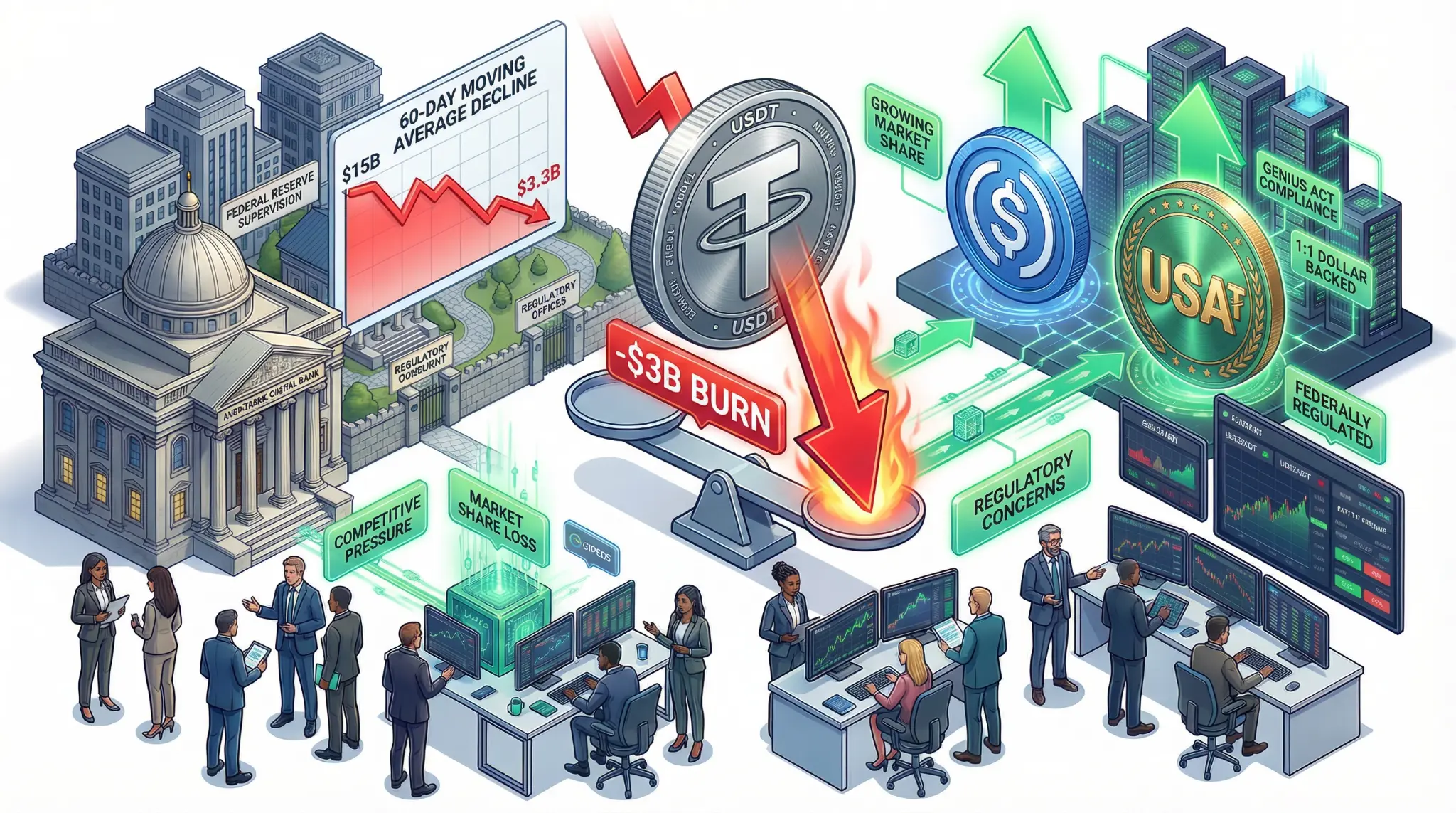

Tether's USDT stablecoin sees demand growth decline from $15B to $3.3B 60-day moving average, with $3B burned in January 2026, signaling potential market share shift to USDC and USA₮.

Crypto Adoption Reaches 39% in US Retail: Stablecoins and Fintech Drive Mainstream Payments Inflection Point

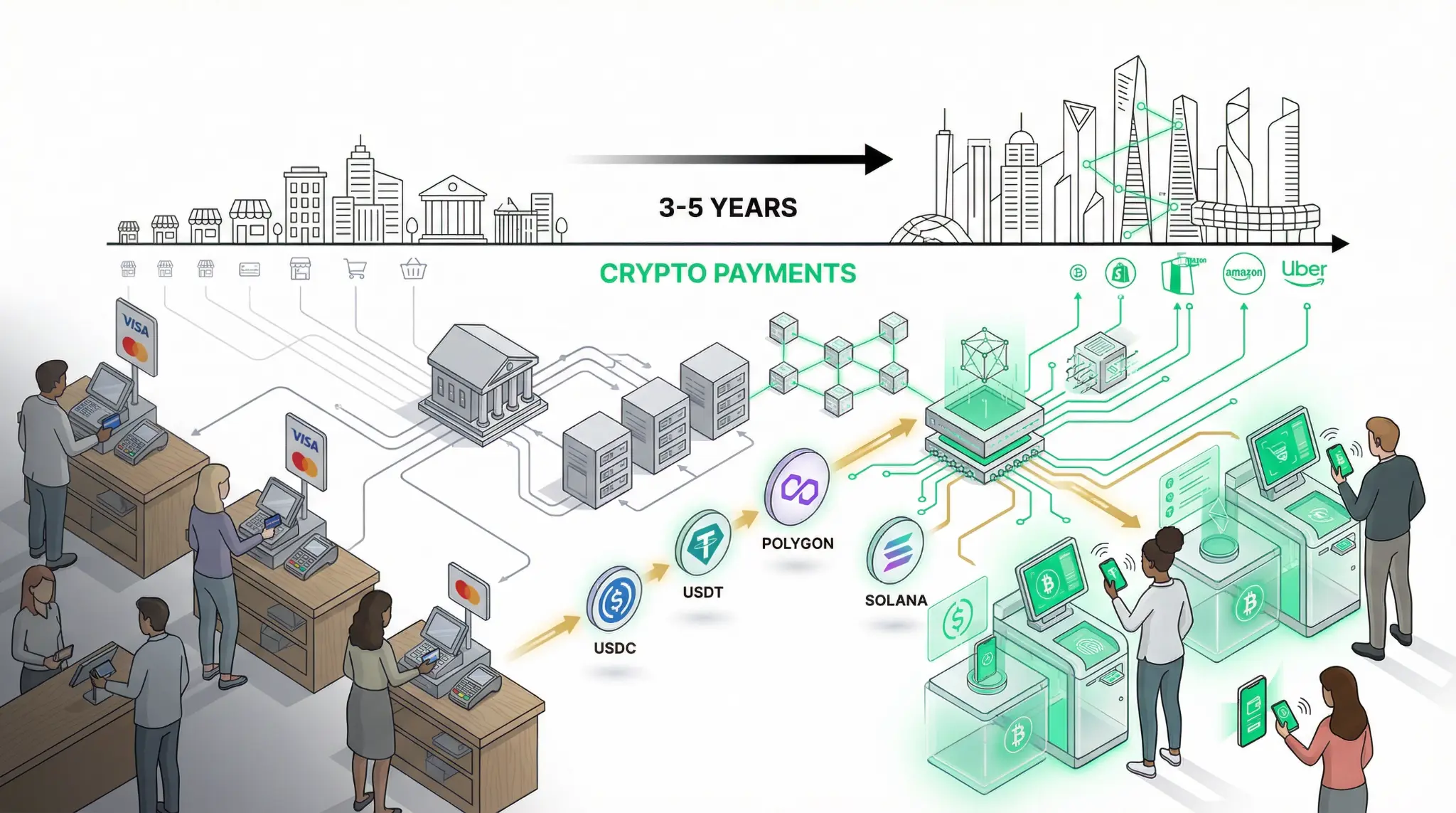

In a landmark report that demonstrates the accelerating mainstream adoption of cryptocurrency, AInvest has released analysis showing that cryptocurrency adoption in US retail payments has reached 39% in 2025, driven primarily by stablecoins and fintech platforms like PayPal. This represents a critical inflection point in the adoption curve, suggesting that cryptocurrency is transitioning from a niche asset to a mainstream payment method.