US Banks' Stablecoin Scare: A Flawed Plea to Protect Trillions, or a Call for Fair Competition?

At the heart of the banks' apprehension is the potential for stablecoins, digital currencies pegged to the value of the U.S. dollar, to evolve beyond mere payment mechanisms into interest-bearing savings vehicles. Should this occur, they argue, consumers and corporations alike would be incentivized to move their deposits out of traditional bank accounts and into these higher-yielding digital alternatives. This, in turn, could erode the banks' crucial funding base, impacting their ability to lend and potentially destabilizing the financial system.

"The banks' fear of a $6 trillion exodus is a powerful narrative, but it overlooks the nuances of stablecoin functionality and the broader evolution of financial services," states a recent Breakingviews commentary [1]. "The real threat is not necessarily the scale of the outflow, but the challenge to their long-held dominance in deposit-taking." The debate highlights a growing chasm between the established financial order and the burgeoning world of decentralized finance. Banks, accustomed to a regulatory framework that has historically protected their deposit franchises, are now confronting a new paradigm where innovative digital assets could bypass traditional intermediaries. Their lobbying efforts, often framed as safeguarding financial stability, are increasingly being viewed as an attempt to stifle competition and maintain the status quo. | Argument from Banks | Counter-Argument/Reality | Impact on Financial Landscape | |---|---|---| | $6 Trillion Deposit Flight | Exaggerated; overlooks how money circulates and stablecoin mechanics. | Potential for deposit reallocation, but not necessarily a systemic collapse. | | Threat to Financial Stability | Stablecoins could introduce new risks, but also offer efficiencies. | Forces regulators to adapt and create a level playing field for innovation. | | Unfair Competition | Banks benefit from existing regulatory advantages and implicit guarantees. | Calls for a re-evaluation of banking regulations to foster fair competition. | | Erosion of Lending Capacity | U.S. banks are not the sole source of credit; other avenues exist. | Encourages diversification of credit sources and financial intermediation. | | Regulatory Arbitrage | Crypto firms could exploit loopholes to offer interest-bearing products. | Demands clear and comprehensive regulatory frameworks for stablecoins. | Indeed, the notion that U.S. banks are the primary engine of credit for households and corporations is itself a point of contention. The financial landscape has diversified significantly, with non-bank lenders and capital markets playing increasingly prominent roles. Furthermore, the argument that stablecoins pose an existential threat to all banks may be overly broad. Mid-sized regional banks, for instance, are often cited as being more vulnerable due to their smaller scale and less diversified funding sources compared to their larger counterparts. This clash between the banking and crypto lobbies underscores a critical juncture in financial regulation. While banks advocate for stringent controls that would effectively limit stablecoins' competitive potential, proponents of digital assets argue for a framework that fosters innovation while mitigating genuine risks. The outcome of this debate will not only shape the future of stablecoins but also redefine the role of traditional banks in an increasingly digitized global economy.

References

[1] Why US banks' stablecoin pleading is flawed [2] US Banks Misjudge Stablecoin Threat [3] The Fed - Banks in the Age of Stablecoins: Some Possible Implications for Deposits, Credit, and Financial Intermediation

Related Articles

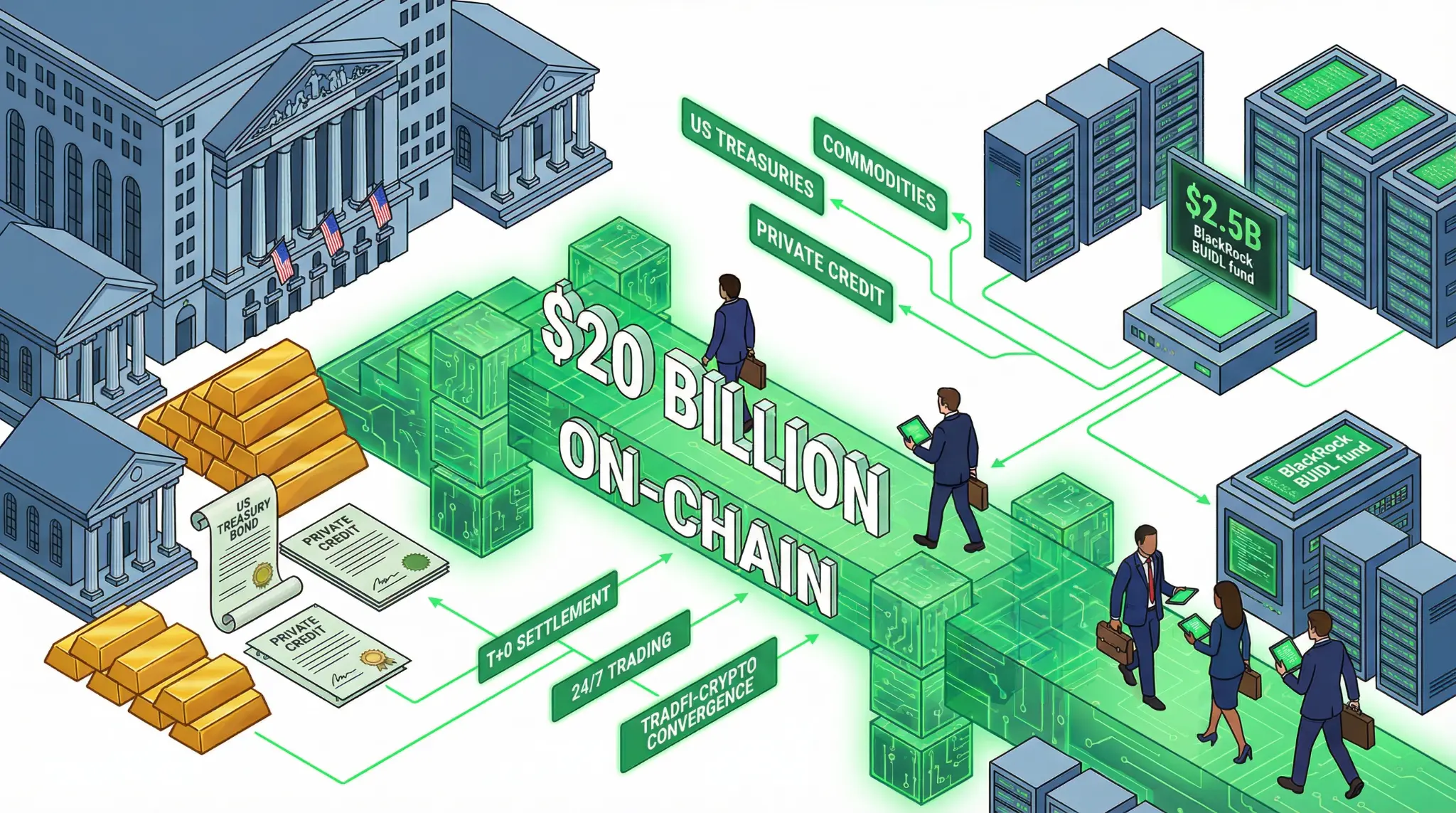

$20 Billion in Tokenized Securities Now On-Chain: The TradFi-Crypto Convergence Accelerates as Wall Street Embraces Blockchain

$20 billion in tokenized securities now on-chain, led by US Treasuries and BlackRock's $2.5B BUIDL fund, with Bernstein projecting 4x growth to $80B by year-end as TradFi-crypto convergence accelerates.

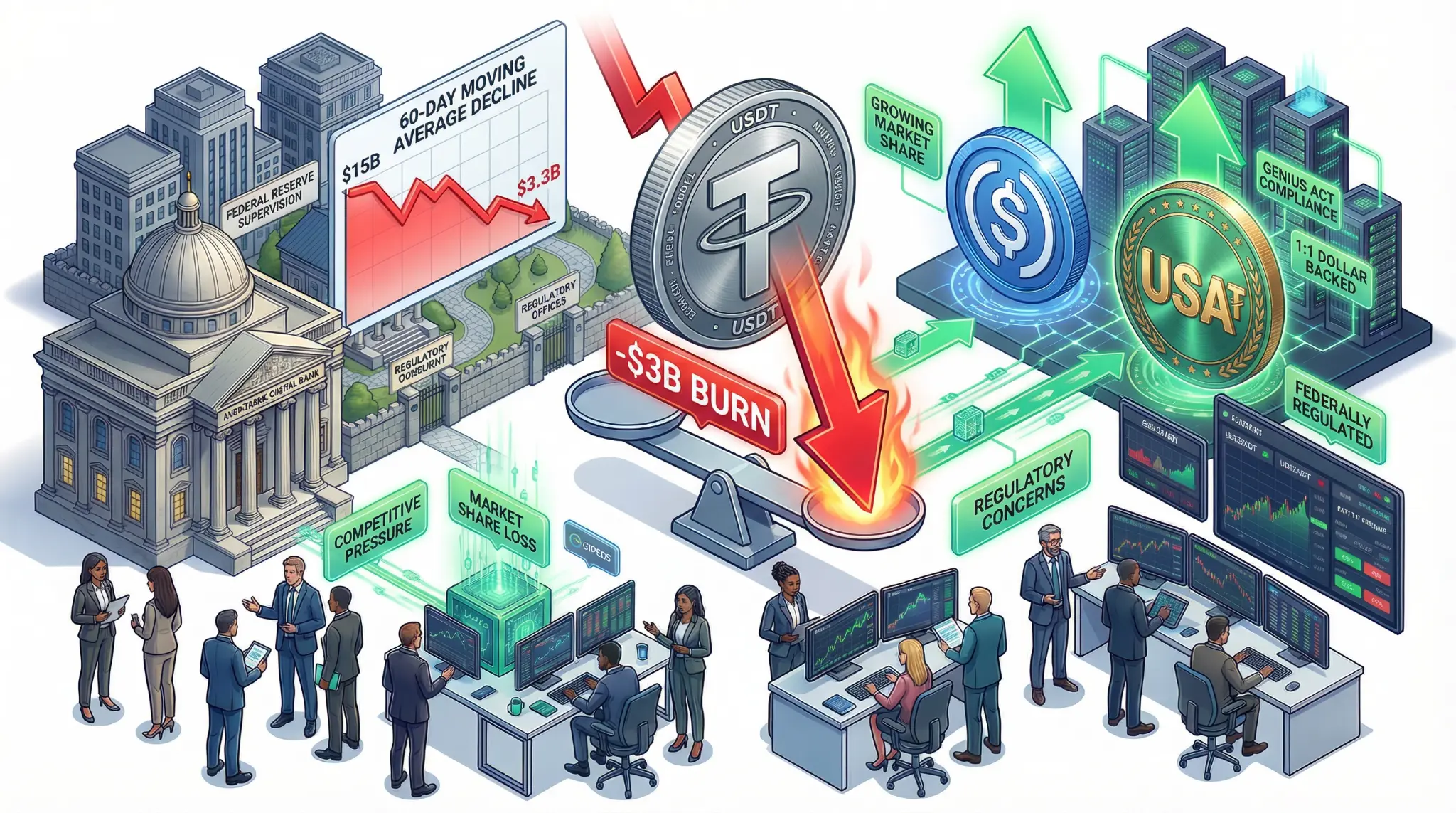

USDT Demand Stalls as Tether Burns $3 Billion: Is the Stablecoin King Losing Its Crown?

Tether's USDT stablecoin sees demand growth decline from $15B to $3.3B 60-day moving average, with $3B burned in January 2026, signaling potential market share shift to USDC and USA₮.

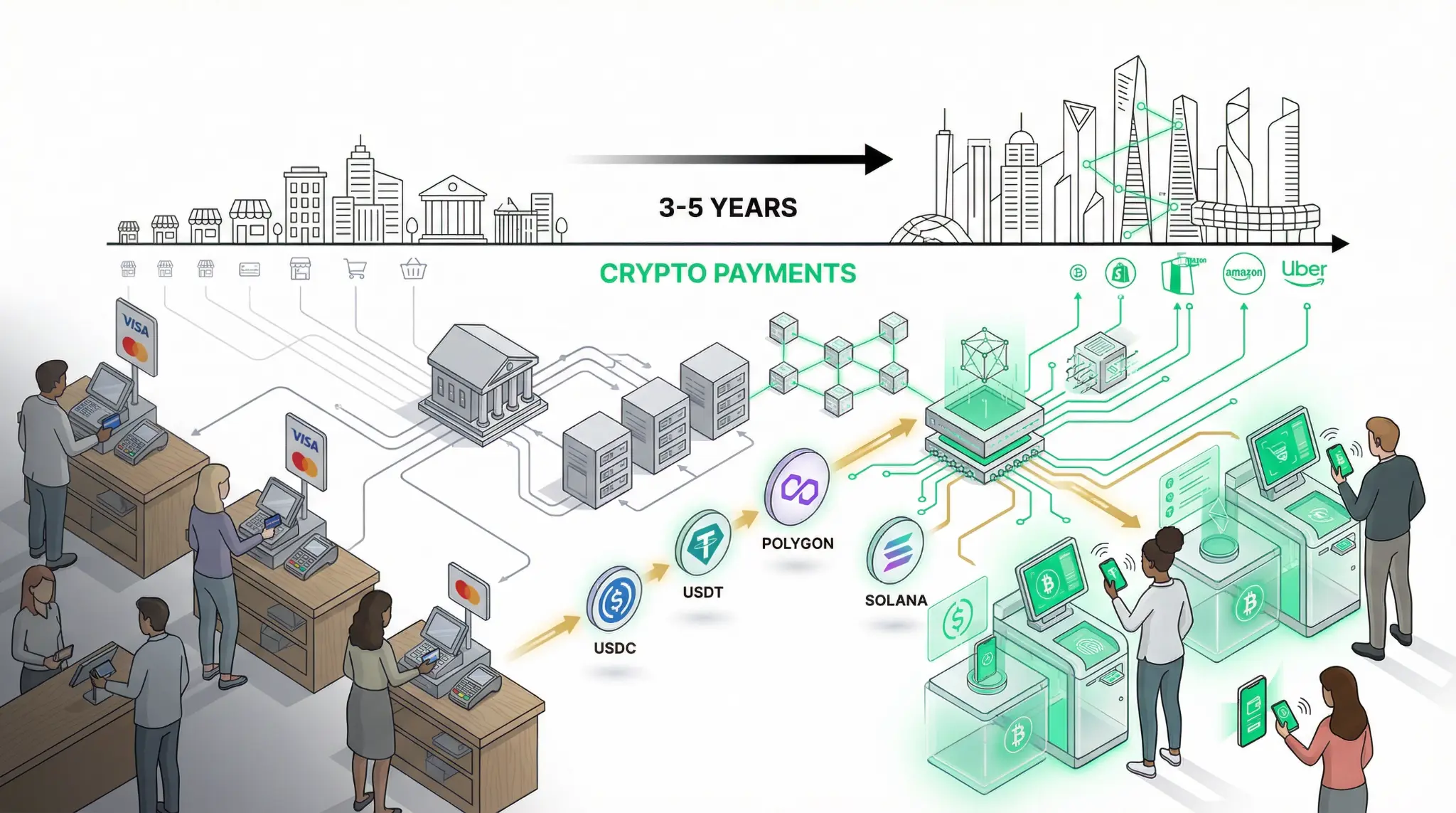

Crypto Adoption Reaches 39% in US Retail: Stablecoins and Fintech Drive Mainstream Payments Inflection Point

In a landmark report that demonstrates the accelerating mainstream adoption of cryptocurrency, AInvest has released analysis showing that cryptocurrency adoption in US retail payments has reached 39% in 2025, driven primarily by stablecoins and fintech platforms like PayPal. This represents a critical inflection point in the adoption curve, suggesting that cryptocurrency is transitioning from a niche asset to a mainstream payment method.