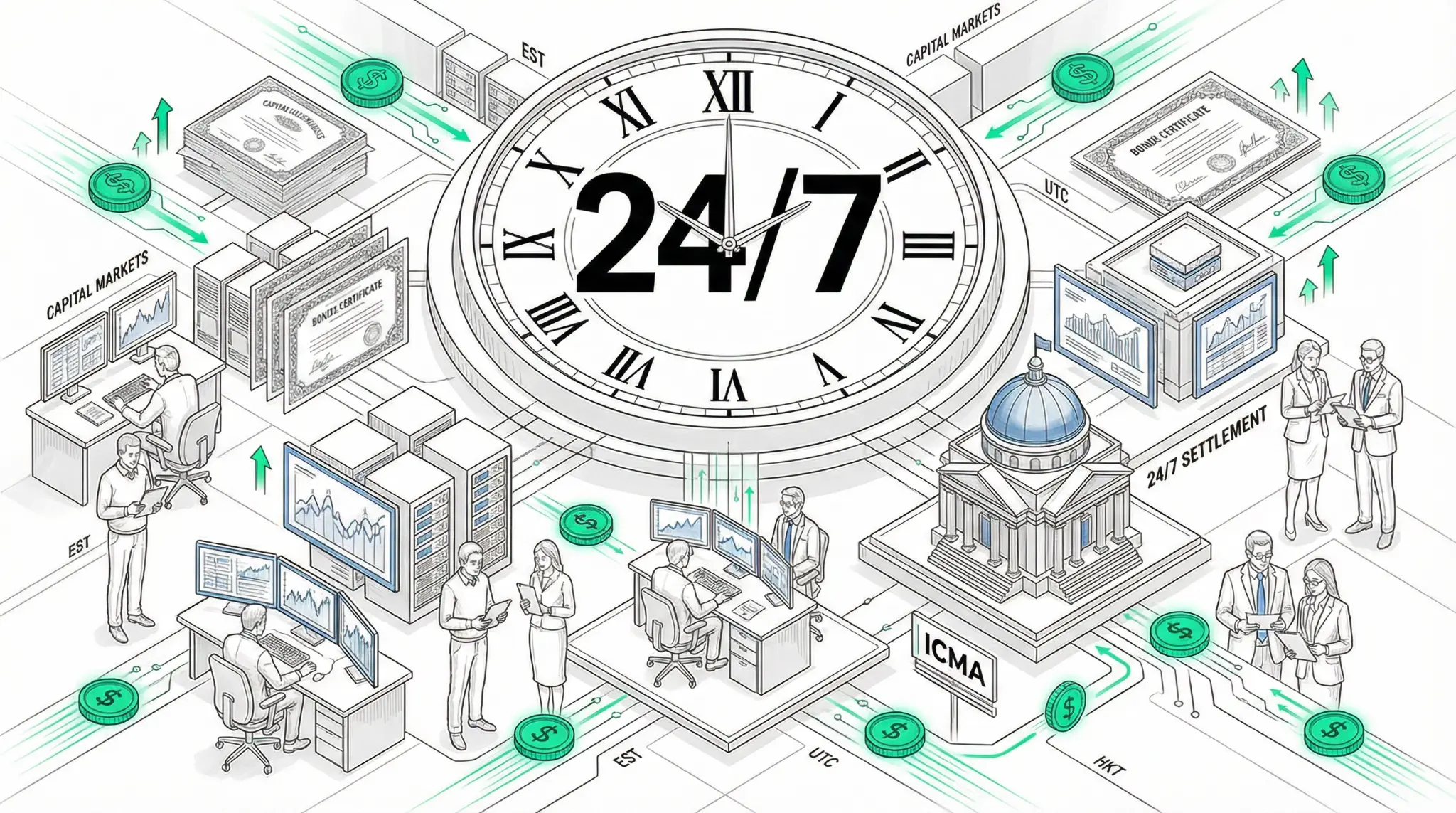

ICMA Examines Stablecoins as Capital Markets Infrastructure: 24/7 On-Chain Settlement is the Future

In a significant institutional endorsement of stablecoins' role in modern finance, the International Capital Market Association (ICMA) has published a detailed paper examining stablecoins as settlement assets for capital markets. The paper focuses on fiat-backed stablecoins alongside wholesale central bank digital currencies (CBDCs), and argues that stablecoins have the potential to unlock 24/7 on-chain settlement, provide liquidity outside traditional market cycles, and extend fixed income products to new wholesale and retail markets. This is not speculation; this is a major financial industry association formally recognizing stablecoins as critical infrastructure.

ICMA's analysis represents a fundamental shift in how traditional finance views stablecoins. For years, stablecoins were dismissed as a niche cryptocurrency product with limited relevance to institutional finance. Now, a leading association representing the global capital markets industry is publishing detailed research on how stablecoins can improve settlement efficiency and expand market access. This is the moment when stablecoins transition from being viewed as a threat to being viewed as an essential component of modern financial infrastructure.

"Stablecoins have the potential to fundamentally transform capital markets settlement," ICMA's analysis noted. "By enabling 24/7 on-chain settlement, stablecoins can dramatically reduce settlement risk, free up capital, and enable new market structures that were previously impossible. The question is no longer whether stablecoins will play a role in capital markets; the question is how quickly institutions will adopt them."

The key insight in ICMA's paper is that stablecoins enable a fundamentally different model of capital markets settlement. Traditional settlement operates on a T+1 or T+2 basis, meaning that trades settle one or two days after execution. This delay creates settlement risk, ties up capital, and limits market efficiency. Stablecoins, by contrast, enable near-instant settlement on a 24/7 basis. A trade can be executed and settled in seconds, at any time of day or night, regardless of whether traditional markets are open.

The implications of this shift are profound. If capital markets move to 24/7 on-chain settlement using stablecoins, the entire structure of global finance changes. Trading floors operating on fixed schedules become obsolete. Settlement risk is dramatically reduced. Capital efficiency improves. New market structures become possible—for example, continuous auctions rather than discrete trading sessions.

ICMA's analysis also highlights the potential for stablecoins to extend fixed income products to new markets. Currently, fixed income markets are dominated by institutional investors and high-net-worth individuals. Retail investors have limited access to bonds, notes, and other fixed income instruments. Stablecoins could change this by enabling fractional ownership of fixed income securities and by reducing the minimum investment sizes required to participate in these markets.

For traders, quants, and investors, ICMA's paper is significant because it signals that institutional adoption of stablecoins is accelerating. Major financial industry associations are not publishing detailed research on technologies that they view as speculative or temporary. They are publishing research on technologies that they believe will become fundamental to how markets operate. This suggests that stablecoin adoption in capital markets is likely to accelerate significantly over the next 2-3 years.

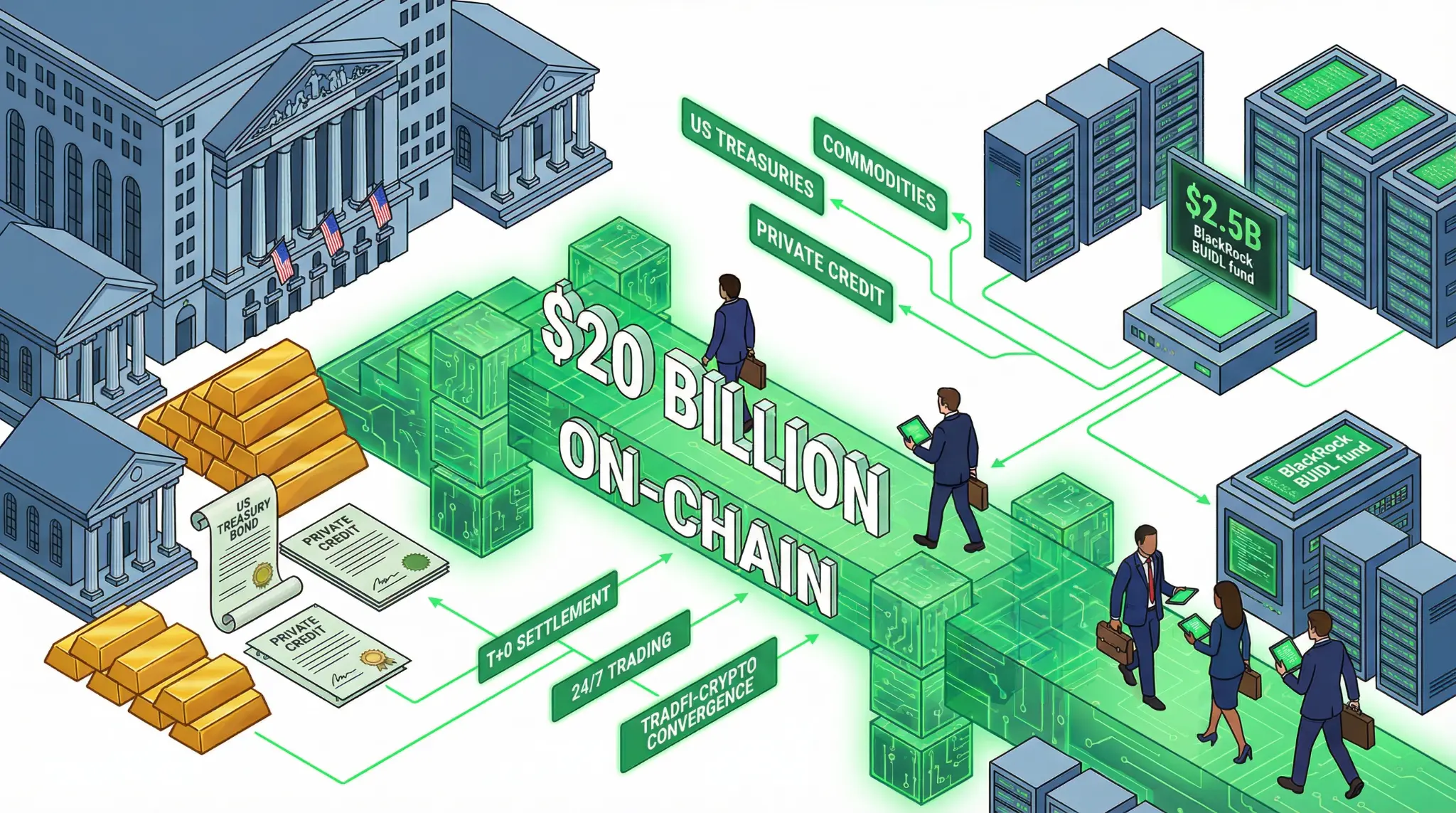

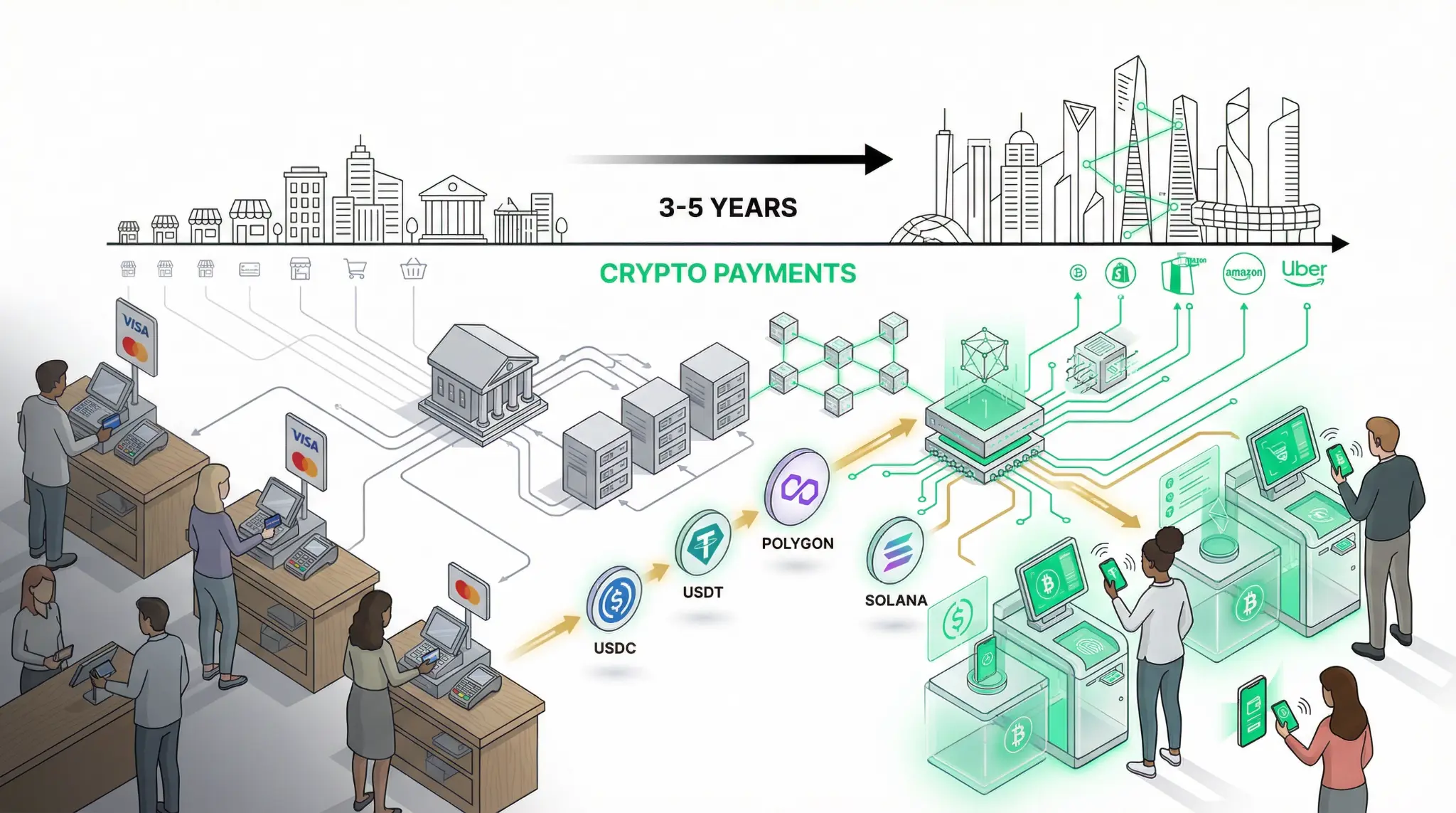

The paper also has implications for the broader adoption of blockchain technology. If stablecoins become the standard settlement asset for capital markets, then blockchain networks will become critical infrastructure for global finance. The blockchain networks that support stablecoin settlement—Ethereum, Solana, and others—will become as important as traditional settlement networks like SWIFT and Fedwire.

References

Related Articles

$20 Billion in Tokenized Securities Now On-Chain: The TradFi-Crypto Convergence Accelerates as Wall Street Embraces Blockchain

$20 billion in tokenized securities now on-chain, led by US Treasuries and BlackRock's $2.5B BUIDL fund, with Bernstein projecting 4x growth to $80B by year-end as TradFi-crypto convergence accelerates.

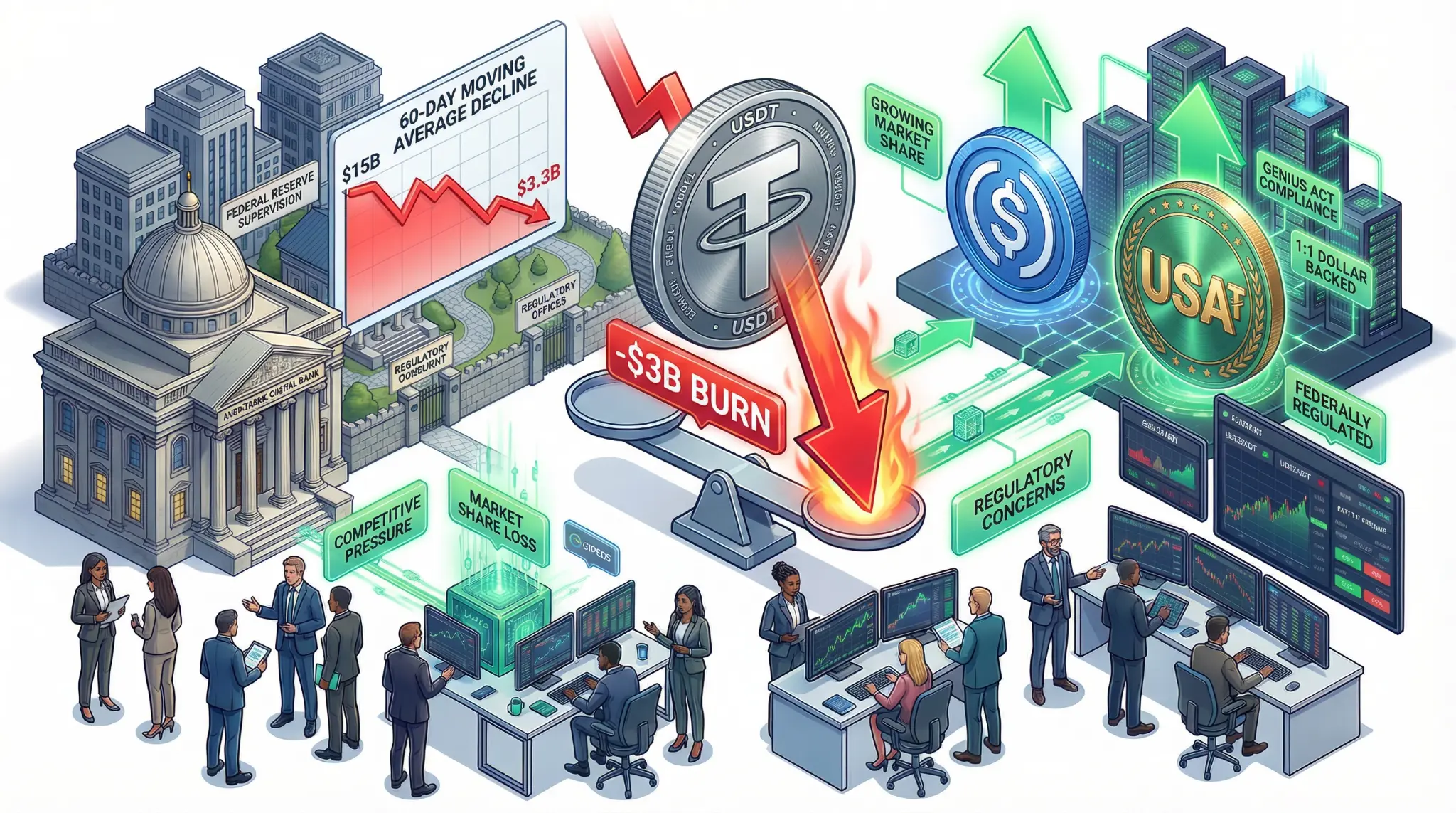

USDT Demand Stalls as Tether Burns $3 Billion: Is the Stablecoin King Losing Its Crown?

Tether's USDT stablecoin sees demand growth decline from $15B to $3.3B 60-day moving average, with $3B burned in January 2026, signaling potential market share shift to USDC and USA₮.

Crypto Adoption Reaches 39% in US Retail: Stablecoins and Fintech Drive Mainstream Payments Inflection Point

In a landmark report that demonstrates the accelerating mainstream adoption of cryptocurrency, AInvest has released analysis showing that cryptocurrency adoption in US retail payments has reached 39% in 2025, driven primarily by stablecoins and fintech platforms like PayPal. This represents a critical inflection point in the adoption curve, suggesting that cryptocurrency is transitioning from a niche asset to a mainstream payment method.