Silver Explodes to Record $110: The Industrial Metal Outpaces Gold in Historic Surge

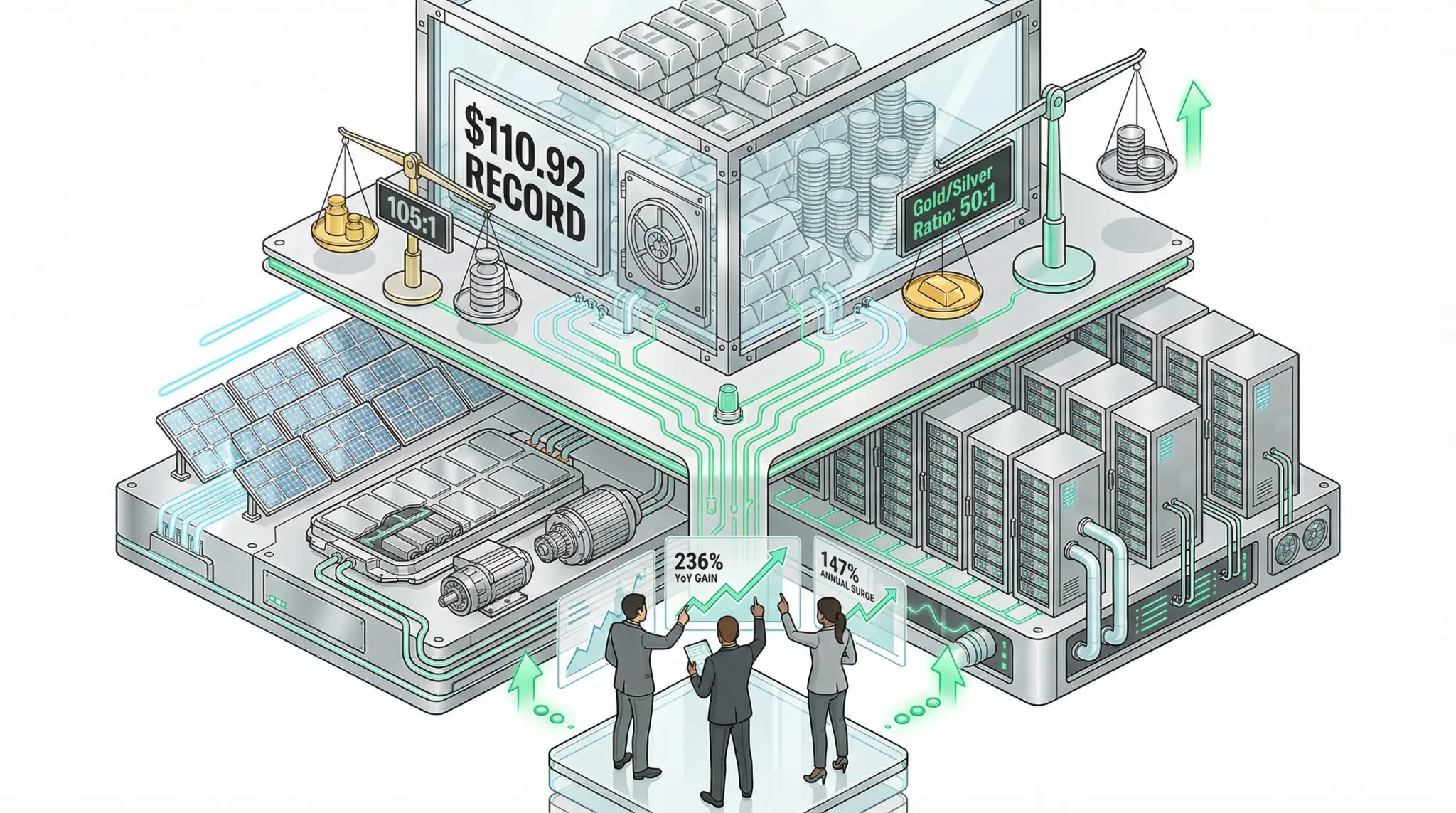

January 26, 2026 - In a remarkable display of momentum that has left even seasoned precious metals traders stunned, silver surged to a record high of $110.92 per ounce on Monday, January 26, 2026, before settling around $110.56 [1]. This represents a staggering 236% year-over-year gain and a 147% surge in 2025 alone—a performance that has dramatically compressed the gold-to-silver ratio from 105:1 in April to just 50:1 today [1][2]. Silver is no longer just a precious metal; it has become a proxy for industrial recovery, geopolitical hedging, and retail investor conviction in a world where traditional assets feel increasingly risky.

The magnitude of silver's rally is almost incomprehensible when viewed in historical context. To find a year with comparable performance, you have to go back decades. Silver is not moving on sentiment alone; it is moving on a combination of safe-haven demand, industrial demand, and a structural supply deficit that has persisted for years. The Silver Institute has projected a fifth consecutive annual deficit in 2025, meaning that global demand for silver exceeds global supply [2]. When supply is constrained and demand is rising, prices have only one direction to go.

"Silver's rally reflects both safe-haven demand and genuine industrial demand," FX Leaders analyst Arslan Butt noted. "The metal is consolidating just below the $110 level following one of the strongest multi-month rallies in the metal's history. Unlike short-lived speculative spikes, recent price action suggests steady accumulation, with pullbacks attracting buyers rather than triggering liquidation." [2]

The drivers of silver's extraordinary performance are multifaceted. Like gold, silver benefits from safe-haven demand as investors hedge against geopolitical uncertainty and currency debasement. But silver has an additional advantage: it is an essential industrial metal. Silver is crucial in the production of electric vehicles, solar panels, and AI data centers—three of the fastest-growing industries in the global economy [1]. As demand for these products accelerates, demand for silver accelerates with it.

The compression of the gold-to-silver ratio is particularly significant. When the ratio is high (as it was at 105:1 in April), it means that gold is expensive relative to silver. When the ratio compresses, it means that silver is catching up to gold in value. This compression reflects a recognition that silver's industrial demand is becoming increasingly important. In a world transitioning to renewable energy and electric vehicles, silver is not just a precious metal; it is an essential commodity.

| Silver Market Metric | Figure | Significance |

|---|---|---|

| Record High (Jan 26) | $110.92 per ounce | All-time high, first time above $110. |

| Trading Range (Jan 26) | $109.29-$110.68 | Consolidation near record levels. |

| 2025 Annual Gain | 147% | Massive outperformance. |

| YoY Gain (Jan 2025 to Jan 2026) | 236% | Exceptional appreciation. |

| Gold-to-Silver Ratio (Apr 2025) | 105:1 | Gold was expensive relative to silver. |

| Gold-to-Silver Ratio (Jan 2026) | ~50:1 | Silver has dramatically caught up. |

| Technical Support (4-hour chart) | $103.30-$106.31 | Mid-channel trendline provides support. |

| Next Resistance Targets | $113.50, $118.40 | Potential upside if $110 breaks cleanly. |

There is also a supply-side story that has been largely overlooked by mainstream financial media. Fears that Trump would place tariffs on silver caused a flood of silver into US vaults, which diminished supply in the London trading hub and contributed to rising prices [1]. This is a classic example of how policy uncertainty can create unintended consequences in commodity markets. When investors fear that tariffs will be imposed on a commodity, they rush to secure supply before tariffs take effect. This rush to secure supply drives prices higher, which in turn attracts more speculative demand.

The technical picture for silver is also supportive. According to FX Leaders analysis, silver is trading within a well-defined rising channel that has guided price action since the rebound from the sub-$90 area. The upper boundary of this channel currently aligns with the $109–$110 zone, which explains the consolidation seen in recent candles [2]. Support on the downside is anchored by the mid-channel trendline around $103.30, which has repeatedly acted as dynamic support. If silver breaks above $110 and sustains the breakout, the next targets are $113.50 and $118.40 [2].

The momentum indicators also suggest that the rally is not exhausted. The RSI has eased to around 66, down from overbought levels, but remains firmly in bullish territory. Importantly, there is no bearish divergence between price and momentum, which reduces the likelihood of a deeper correction at this stage [2]. The recent pullback has remained shallow, holding well above the 0.382 retracement of the latest impulse leg, which is consistent with strong trending markets.

For traders, quants, and investors, silver's record high is significant because it signals that investors are not just hedging against geopolitical risk; they are also betting on industrial recovery and the transition to renewable energy. Silver is a barometer of global economic health and technological progress. When silver is rallying as sharply as it is now, it suggests that investors believe the future will require more silver, not less.

The compression of the gold-to-silver ratio also has implications for portfolio construction. Historically, when the ratio compresses, it has been a sign that silver is outperforming and that investors should consider increasing their silver exposure relative to gold. For investors with a long-term horizon, the current environment presents an opportunity to build positions in silver at levels that are still historically attractive relative to gold.

References

[1] Gold Surges Past Record $5,100–Silver Rises More Than 8% [2] Silver Price Forecast: Bulls Eye $110 Breakout as Uptrend Stays Intact

Related Articles

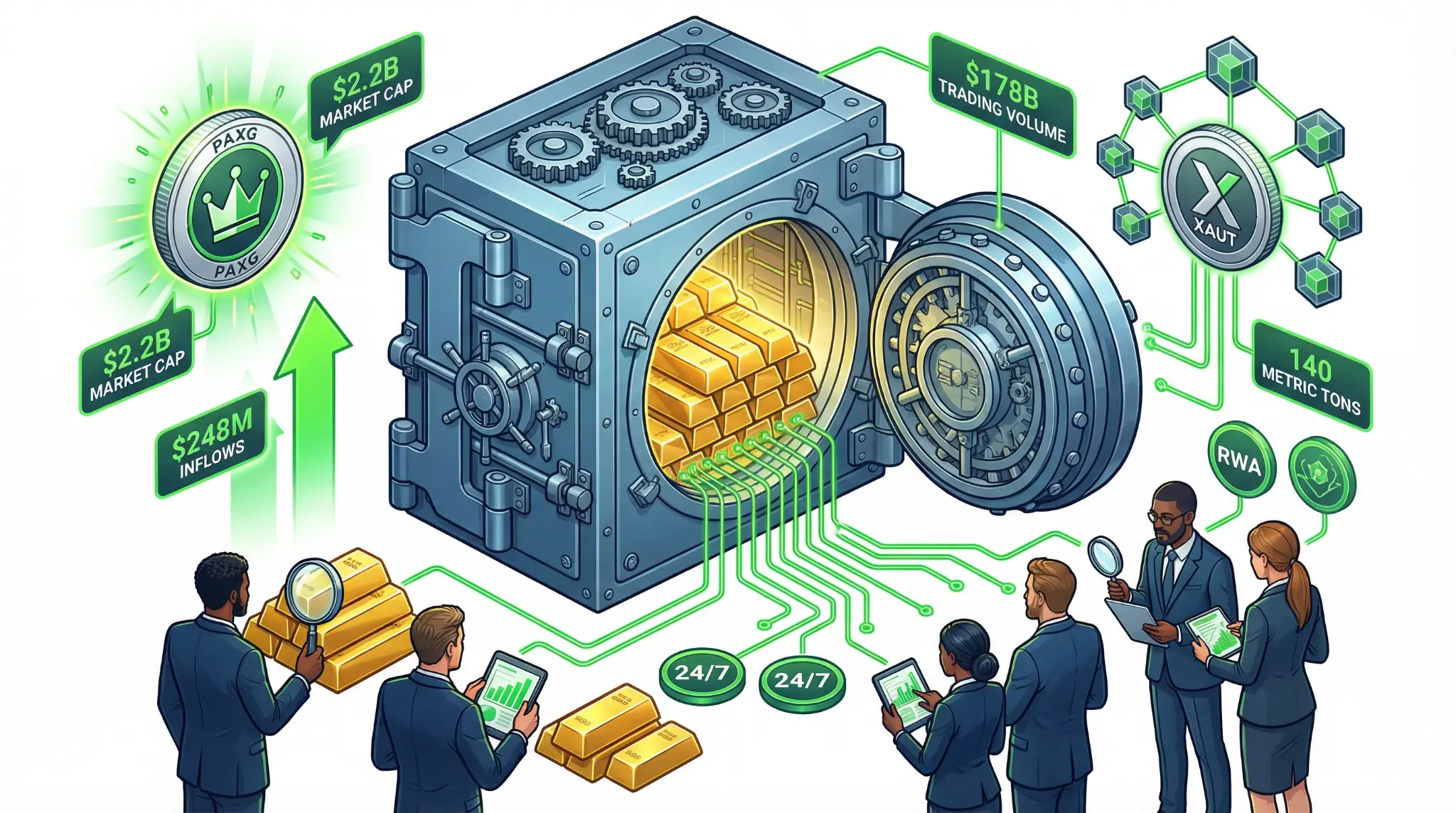

Tokenized Gold Hits $5.8 Billion Market Cap: Paxos and Tether Lead the Real-World Asset Revolution

Tokenized gold market reaches $5.8B market cap with $178B trading volume, led by Paxos Gold ($2.2B) and Tether XAUT (140 metric tons), marking major milestone in real-world asset tokenization.

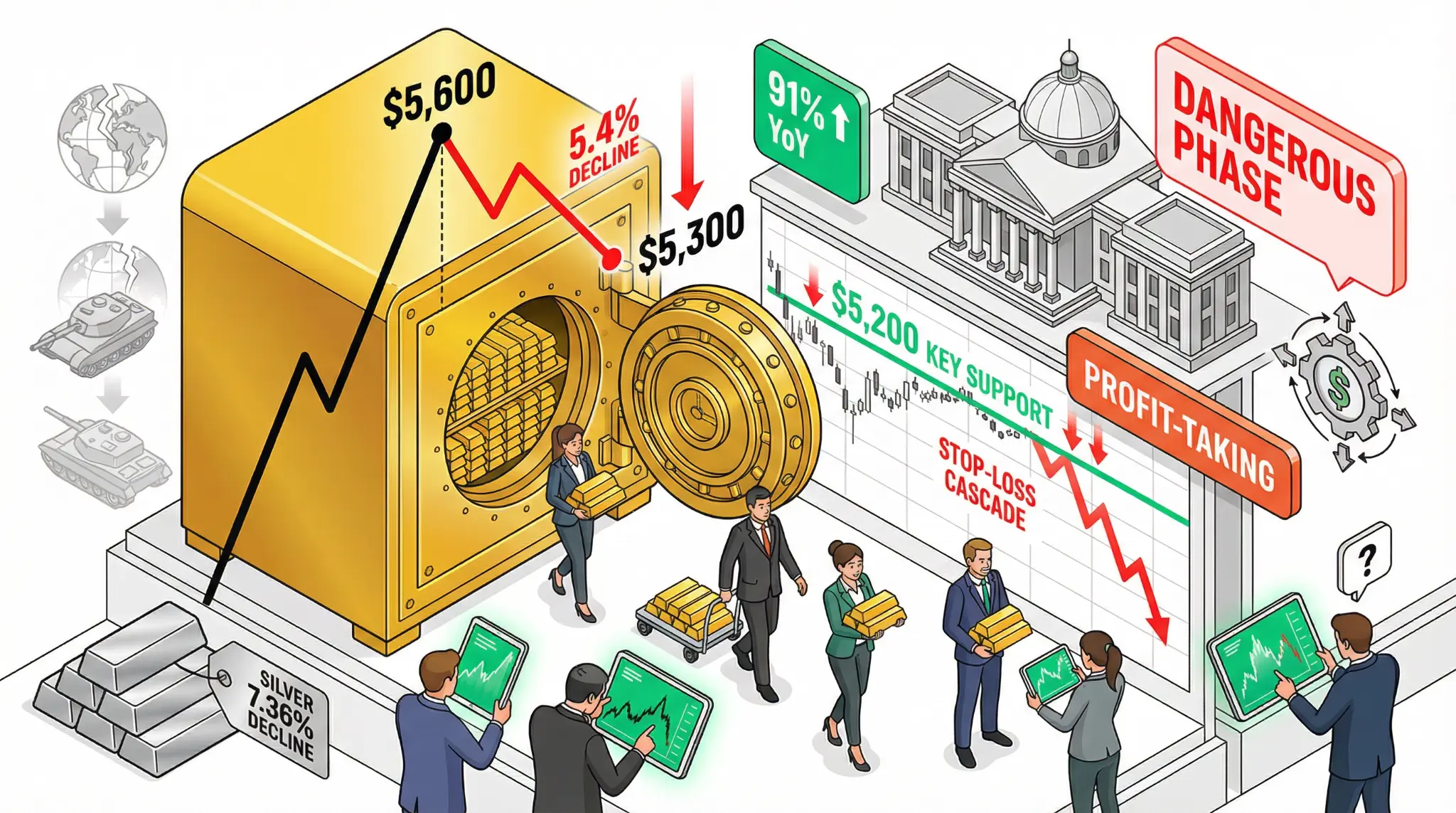

Gold Tumbles from $5,600 Peak to $5,300: Precious Metals Rally Enters 'Dangerous Phase' as Profit-Taking Accelerates

In a sharp reversal that has caught many investors off guard, gold has tumbled from its record peak above $5,600 per ounce to $5,300, a decline of approximately 5.4% in just days. The sharp correction has prompted analysts to warn that the precious metals rally is entering a 'dangerous phase' characterized by profit-taking and potential for further downside. Silver has been hit even harder, sinking 7.36% from its highs above $120 per ounce.

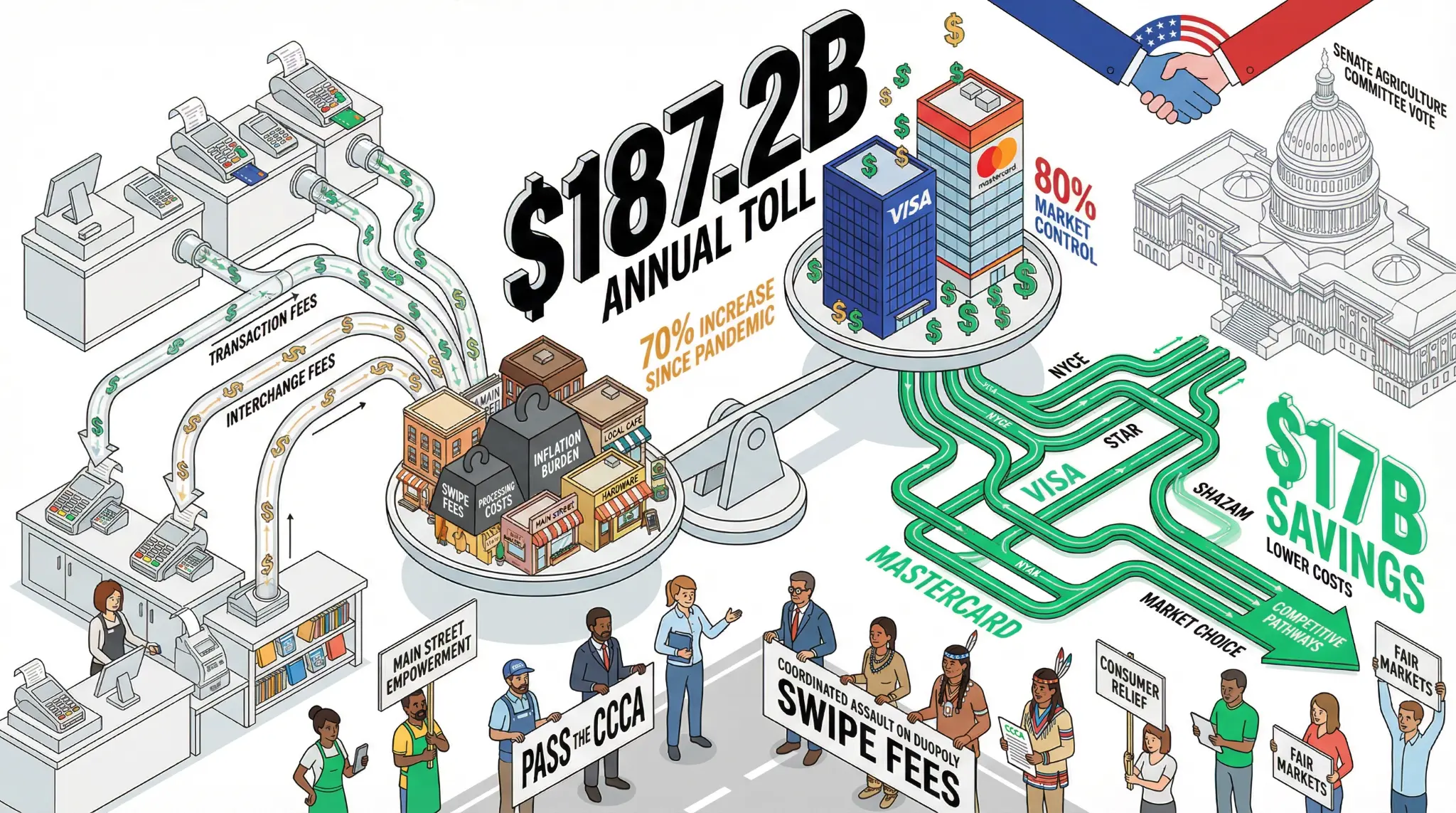

Merchants Coalition Launches Assault on Credit Card Swipe Fees: $187.2B Annual Toll Faces Congressional Challenge

January 26, 2026 - In a coordinated legislative push that has the potential to fundamentally reshape the credit card payments industry, the Merchants Payments Coalition and nearly 350 merchant trade associations have urged the Senate Agriculture Committee to include the Credit Card Competition Act (CCCA) as part of cryptocurrency marketplace structure legislation [1][2]. The move comes just two we