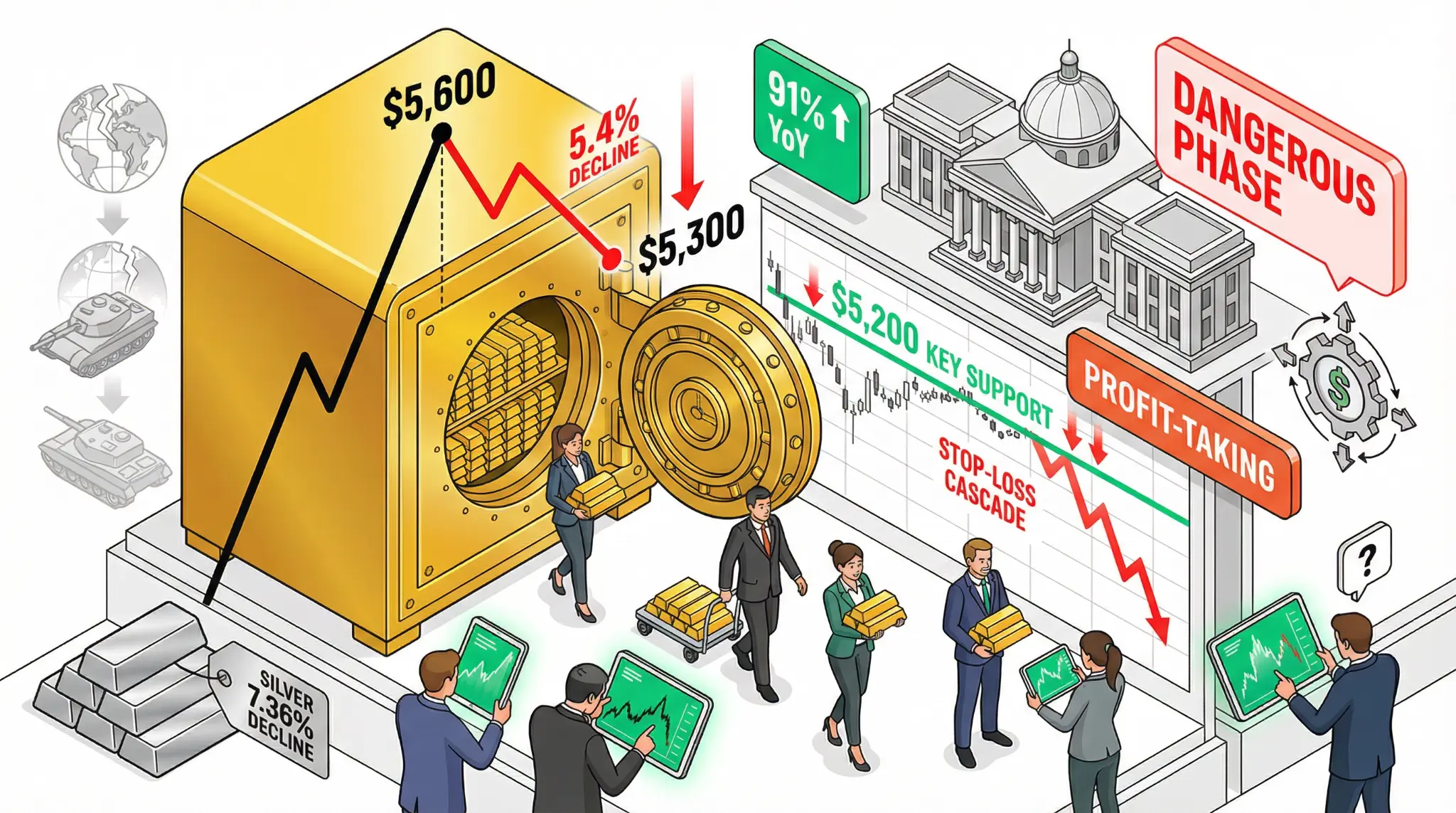

Gold Tumbles from $5,600 Peak to $5,300: Precious Metals Rally Enters 'Dangerous Phase' as Profit-Taking Accelerates

In a sharp reversal that has caught many investors off guard, gold has tumbled from its record peak above $5,600 per ounce to $5,300, a decline of approximately 5.4% in just days. The sharp correction has prompted analysts to warn that the precious metals rally is entering a "dangerous phase" characterized by profit-taking and potential for further downside. Silver has been hit even harder, sinking 7.36% from its highs above $120 per ounce.

The pullback in gold and silver represents a significant technical reversal after an extraordinary rally that saw gold surge 91% year-over-year and silver surge 275% year-over-year. While the rally has been driven by legitimate fundamental factors including geopolitical uncertainty, central bank buying, and dollar weakness, the sharp pullback suggests that the market may have become overextended and that profit-taking is now underway.

"The precious metals rally has been extraordinary, but it has also been characterized by extreme momentum and potentially unsustainable valuations. The current pullback represents a healthy correction, but it could also be the beginning of a more significant reversal," analysts at Bloomberg said in a note.

The pullback has significant implications for the technical structure of the gold market. Gold had been trading in a strong uptrend, with each pullback attracting new buyers. However, the current pullback has broken through several key technical support levels, which could trigger additional selling. If gold falls below $5,200, it could trigger a cascade of stop-loss orders and accelerate the decline.

Pullback Analysis

| Gold Pullback Metric | Figure | Significance |

|---|---|---|

| Peak Price | $5,600+ per ounce | Record high achieved |

| Current Price | $5,300 per ounce | 5.4% decline from peak |

| YoY Performance | +91% | Still up substantially |

| Daily Decline | 4.7% on Jan 29 | Sharp single-day move |

| Silver Decline | 7.36% from highs | Harder hit than gold |

| Key Support Level | $5,200 per ounce | Critical technical level |

| Profit-Taking | Widespread | Reason for correction |

The pullback also has implications for the drivers of the gold rally. Geopolitical uncertainty, central bank buying, and dollar weakness have all been supporting gold prices. However, the sharp pullback suggests that some of these drivers may be weakening. For example, if geopolitical tensions ease or if the dollar stabilizes, gold could face additional downside pressure.

The pullback also has implications for investors who have been bullish on gold. Many investors have been accumulating gold positions in anticipation of further appreciation. The sharp pullback could trigger margin calls and force some investors to liquidate positions, which could accelerate the decline.

However, it is important to note that even at $5,300, gold remains near record highs and is still up substantially year-over-year. For long-term investors, the current pullback could represent a buying opportunity rather than a reason to sell. The fundamental drivers of the gold rally including geopolitical uncertainty, central bank buying, and dollar weakness remain in place.

For traders, quants, and investors, the gold pullback is significant for several reasons. First, it demonstrates that even strong rallies can experience sharp corrections. Second, it suggests that profit-taking is underway after an extraordinary rally. Third, it indicates that technical support levels are important for determining future price direction. Fourth, it could create trading opportunities for both long and short positions.

Related Articles

Economists Sound Alarm: The Sovereign-Stablecoin Nexus Threatens Global Financial Stability

For years, stablecoins, those digital assets pegged to traditional currencies, have been lauded for their promise of stability in the volatile crypto landscape. Yet, new research from the International Monetary Fund (IMF) and the Swiss National Bank (SNB) suggests that their growing entanglement wit

The Stablecoin Revolution: Regulators Race to Tame the Digital Dollar Beast

For years, stablecoins were the unsung workhorses of the crypto market, facilitating seamless movement between volatile digital assets. However, their utility has expanded dramatically. The 'State of Crypto 2025 report' by a16z crypto revealed a staggering 106% increase in stablecoin transaction vol

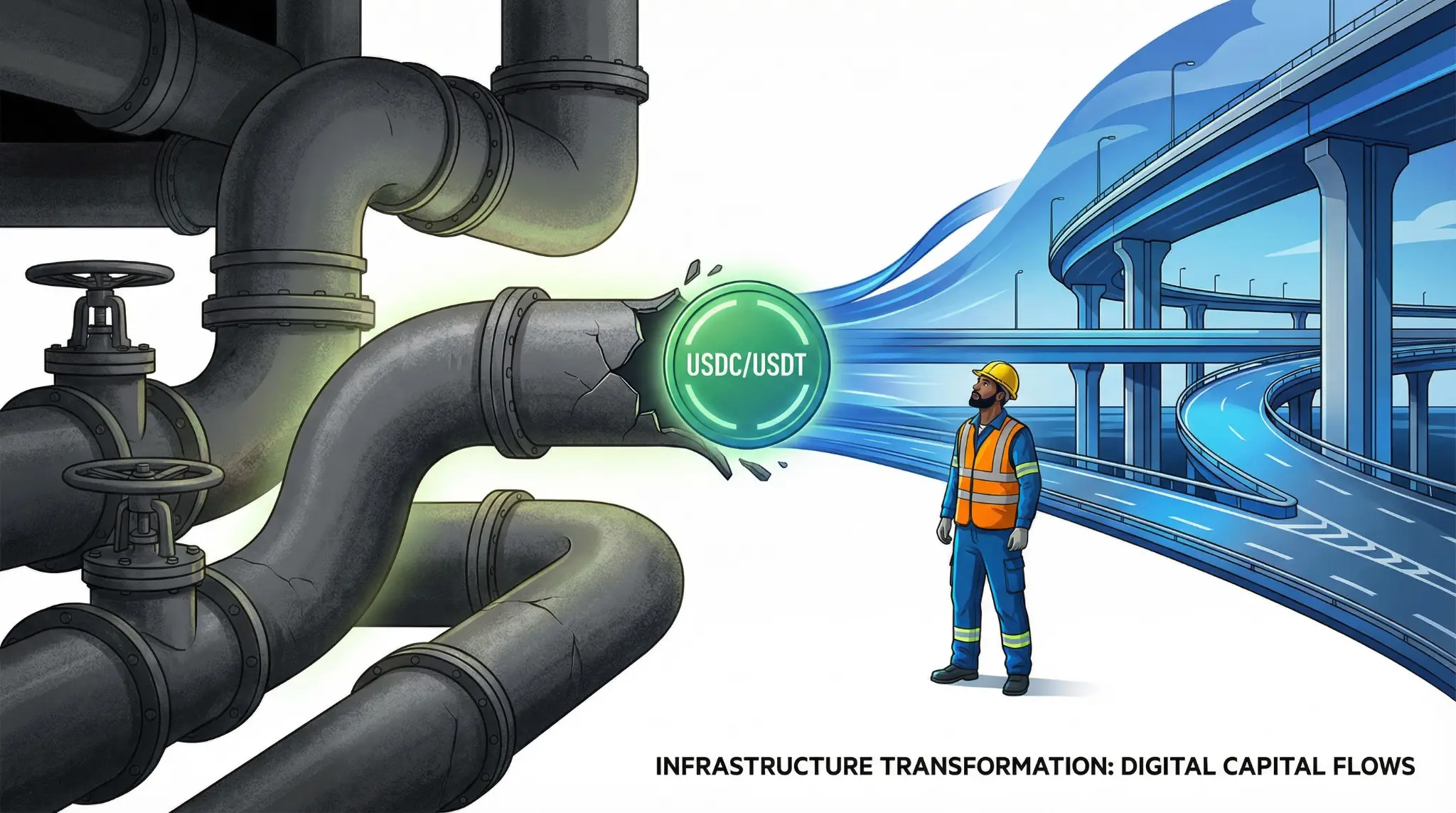

Stablecoins: From Crypto Plumbing to Global Payments Powerhouse - The 2026 Forecast

Visa, the undisputed titan of traditional payments, has already signaled this monumental transition with its expanded adoption of USDC for core settlement operations. This isn't just an endorsement; it's a declaration that stablecoins are now viewed as legitimate settlement rails, stepping into a ro