MEXC and Ether.fi Launch Co-Branded Crypto Card: 4% Cashback Brings Self-Custody to 150M+ Merchants

January 26, 2026 - In a development that signals the maturation of crypto payment infrastructure, MEXC and Ether.fi have launched a co-branded cryptocurrency credit card that enables users to spend their digital assets at over 150 million Visa merchants globally while maintaining full non-custodial control of their assets [1]. The card offers up to 4% cashback on all purchases with no annual fees, is compatible with Apple Pay and Google Pay, and is available in 60+ countries spanning Asia, Europe, and South America [1]. This is not just another crypto card; it is a fundamental reimagining of how users interact with their digital assets in the real world.

The significance of this launch cannot be overstated. For years, the crypto industry has been dominated by centralized exchanges and custodial wallets that require users to trust third parties with their assets. Ether.fi is different. The company describes itself as a "DeFi bank"—one designed to offer a full end-to-end alternative to traditional financial institutions, built atop self-custodial crypto rails. By partnering with MEXC, one of the world's largest crypto exchanges with over 40 million users, Ether.fi is bringing self-custody to the mainstream [1].

"It puts a lot more power in the hands of users," Ether.fi CEO Mike Silagadze told Decrypt. "It's really just objectively a much better product for people. We have the ability to provide more rewards for users. It could be a really easy way to on-ramp onto the U.S. dollar and use that as savings and spending assets in their local economy—or if you're already based in the U.S., a higher rewards financial product." [1]

The card's 4% cashback offer is competitive with premium credit cards offered by traditional financial institutions, but with a critical difference: users retain full custody of their assets. This is a game-changer for users who have been forced to choose between the convenience of traditional payment networks and the security and control offered by self-custody. The MEXC x Ether.fi card eliminates this false choice.

The card's technical architecture is also noteworthy. Users can choose to either spend or borrow against their crypto, with competitive conversion rates prioritized. The user interface is designed for both crypto newcomers and existing digital asset users, which suggests that Ether.fi is targeting a broad market rather than just crypto enthusiasts. To obtain a card, users need to complete advanced Know Your Customer verification and fill out an application form. From there, an Ether.fi account can be topped up via bank transfers or non-custodial wallets, and a virtual card becomes available [1].

| MEXC x Ether.fi Card Metric | Details | Significance |

|---|---|---|

| Cashback Reward | Up to 4% on all purchases | Competitive with premium credit cards. |

| Annual Fee | None | Removes friction for adoption. |

| Merchant Acceptance | 150M+ Visa merchants globally | Near-universal acceptance. |

| Mobile Integration | Apple Pay and Google Pay | Seamless mobile payments. |

| Geographic Availability | 60+ countries (Asia, Europe, South America) | Global reach. |

| Custody Model | Non-custodial | Users retain full asset control. |

| New User Incentive | 15 USDT airdrop for 100+ USDT deposit | Aggressive user acquisition. |

| Referral Rewards | 10 USDT per referral + 1% cashback on referrals' purchases | Network effects. |

The launch promotions are particularly aggressive. New users depositing 100+ USDT are eligible for a 15 USDT airdrop, which represents a 15% instant return on the minimum deposit. During January, there is up to 15% cashback on food and dining purchases. The referral program rewards 10 USDT for every person you onboard, as well as 1% cashback on the purchases they subsequently make [1]. These incentives are designed to drive rapid user acquisition and network effects.

The partnership between MEXC and Ether.fi also has broader implications for the crypto ecosystem. MEXC is one of the largest crypto exchanges by trading volume, with a global user base of over 40 million. By partnering with Ether.fi, MEXC is signaling that it sees the future of crypto as being tied to real-world utility and payments, not just trading and speculation. This is a significant shift in how major crypto exchanges are positioning themselves.

Ether.fi CEO Mike Silagadze has articulated a vision of a future where crypto becomes a mainstream alternative to traditional banking. "The market is evolving toward much more real-world use cases of crypto in people's day-to-day lives," he noted [1]. This is not speculation; this is a statement of fact based on the trajectory of adoption. As more users discover that crypto payments offer superior economics and greater control than traditional payment methods, adoption will accelerate.

For traders, quants, and investors, the MEXC x Ether.fi card launch is significant for several reasons. First, it demonstrates that the infrastructure for mainstream crypto adoption is being built. Second, it shows that major crypto companies are moving beyond trading and speculation to focus on real-world utility. Third, it indicates that the competitive advantage of traditional payment networks like Visa and Mastercard is being eroded by crypto-native alternatives. Fourth, it suggests that self-custody and non-custodial solutions are becoming mainstream, not niche.

The card's availability in 60+ countries is also significant. It suggests that crypto payment infrastructure is becoming truly global, not just concentrated in a few developed markets. This could accelerate the adoption of crypto payments in emerging markets where traditional payment infrastructure is weak or expensive.

References

[1] MEXC and Ether.fi's Crypto Card 'Puts Power in the Hands of Users'

Related Articles

Tether Launches USA₮: The First Federally Regulated Stablecoin Marks a Watershed Moment for Digital Dollars

Tether launches USA₮, the first federally regulated stablecoin under the GENIUS Act framework, issued by Anchorage Digital Bank with Cantor Fitzgerald custody, marking a watershed moment in stablecoin legitimization.

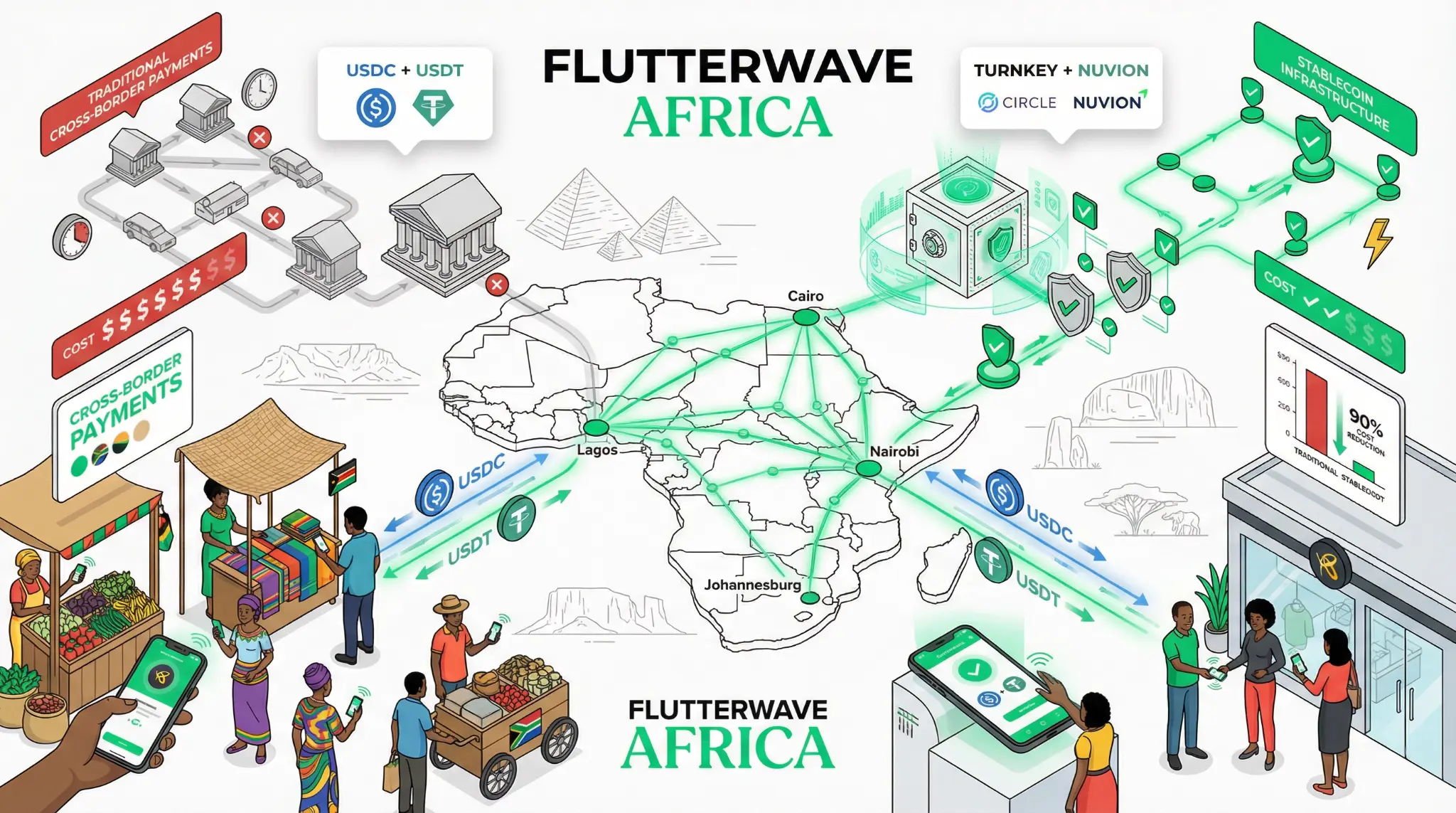

Flutterwave Explores Stablecoin Wallets: Africa's Leading Fintech Launches Secure USDC/USDT Balances for Cross-Border Payments

In a strategic move that brings stablecoin infrastructure to Africa's largest fintech ecosystem, Flutterwave has announced a partnership with Turnkey and Nuvion to launch secure stablecoin balances (USDC and USDT) for merchants and users across Africa. The initiative is designed to dramatically reduce the cost and friction of cross-border payments, which have historically been a major pain point for African businesses and consumers.